Let’s face it: Disney holidays may be very costly. There isn’t any pixie mud to magically make the prices cheaper.

Nonetheless, there are methods you need to use to economize and earn additional rewards out of your journey.

Whether or not touring solo as a Misplaced Boy or vacationing with all the Familia Madrigal, utilizing the precise bank card can take a few of the sting out of continually rising prices related to a visit to essentially the most magical place on earth.

Here is a take a look at the very best bank cards for Disney journeys.

Greatest Disney bank cards

Chase and Disney have two cobranded bank cards. Nonetheless, these playing cards earn Disney {dollars}, which limits redemption flexibility.

With the Chase Disney bank cards, you’ll be able to earn and redeem Disney Rewards {Dollars} for on-property accommodations, park tickets and on-property meals. These are essential (and dear) parts of your Disney journey.

The Disney® Visa® Card has no annual payment and earns 1% in Disney Rewards {dollars} on all purchases. It additionally presently comes with a welcome supply of $200 assertion credit score after spending $500 inside the first three months of account opening.

The Disney® Premier Visa® Card has a $49 annual payment and is the higher possibility for many households as a result of it gives broader incomes and redemption classes. It earns 5% in Disney Rewards {Dollars} on card purchases made straight at DisneyPlus.com, Hulu.com or ESPNPlus.com, 2% on purchases at fuel stations, grocery shops, eating places and most Disney U.S. areas and 1% on all of your different purchases. It additionally comes with a welcome supply of a $400 assertion credit score after spending $1,000 inside the first three months of account opening.

One of the best Disney bank card will differ from individual to individual. And the reply is probably not a “Disney bank card” in any respect. For most individuals, incomes a mixture of factors from numerous bank cards might be most helpful because of the flexibility this technique gives. There are a lot better choices than these cobranded Disney playing cards you can use to your subsequent journey to Disney, which might show you how to maximize your earnings.

Every day E-newsletter

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Associated: Are the Disney Visa bank cards value it?

Different greatest bank cards for Disney

There are a number of parts concerned in your journey. Here is an summary of the very best playing cards for Disney, relying on which bills you are :

*The data for these playing cards has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Greatest bank cards for utilizing factors on Disney accommodations

The Disney Premier Visa and Disney Visa permit you to redeem Rewards {Dollars} for Disney accommodations and resorts. One Rewards Greenback is value $1 towards your invoice. If you do not have these playing cards, further strategies exist to pay for Disney accommodations with factors.

The Swan, Dolphin and Swan Reserve are on Disney property at Disney World and embrace many Disney perks. Since they’re a part of the Marriott household, you need to use your Marriott Bonvoy factors and free evening certificates to remain on Disney property.

What number of factors you want for an evening at these Marriott accommodations varies, beginning at round 40,000 factors per evening. This makes the Marriott Bonvoy Boundless Credit score Card and Marriott Bonvoy Good American Specific Card nice bank card selections for reserving on-site lodging with resort factors.

Close to Disney World and Disneyland, you can also get pleasure from a handful of Disney advantages at some off-property accommodations. These open the potential for utilizing Hilton Honors, Wyndham Rewards and IHG One Rewards factors to your resort keep whereas having fun with advantages like early entry and complimentary shuttles to parks.

If you wish to use your resort factors and are not anxious about these additional advantages, there are high quality choices close to Walt Disney World and Disneyland from not simply these applications but in addition World of Hyatt and Marriott Bonvoy.

Redeeming factors at no cost resort nights can considerably cut back the prices of a Disney trip. An enormous sign-up bonus from bank cards in these applications may show you how to snag a number of nights at a resort close to Disney utilizing factors reasonably than money.

Past the resort applications, bank card factors additionally might help you pay for Disney accommodations.

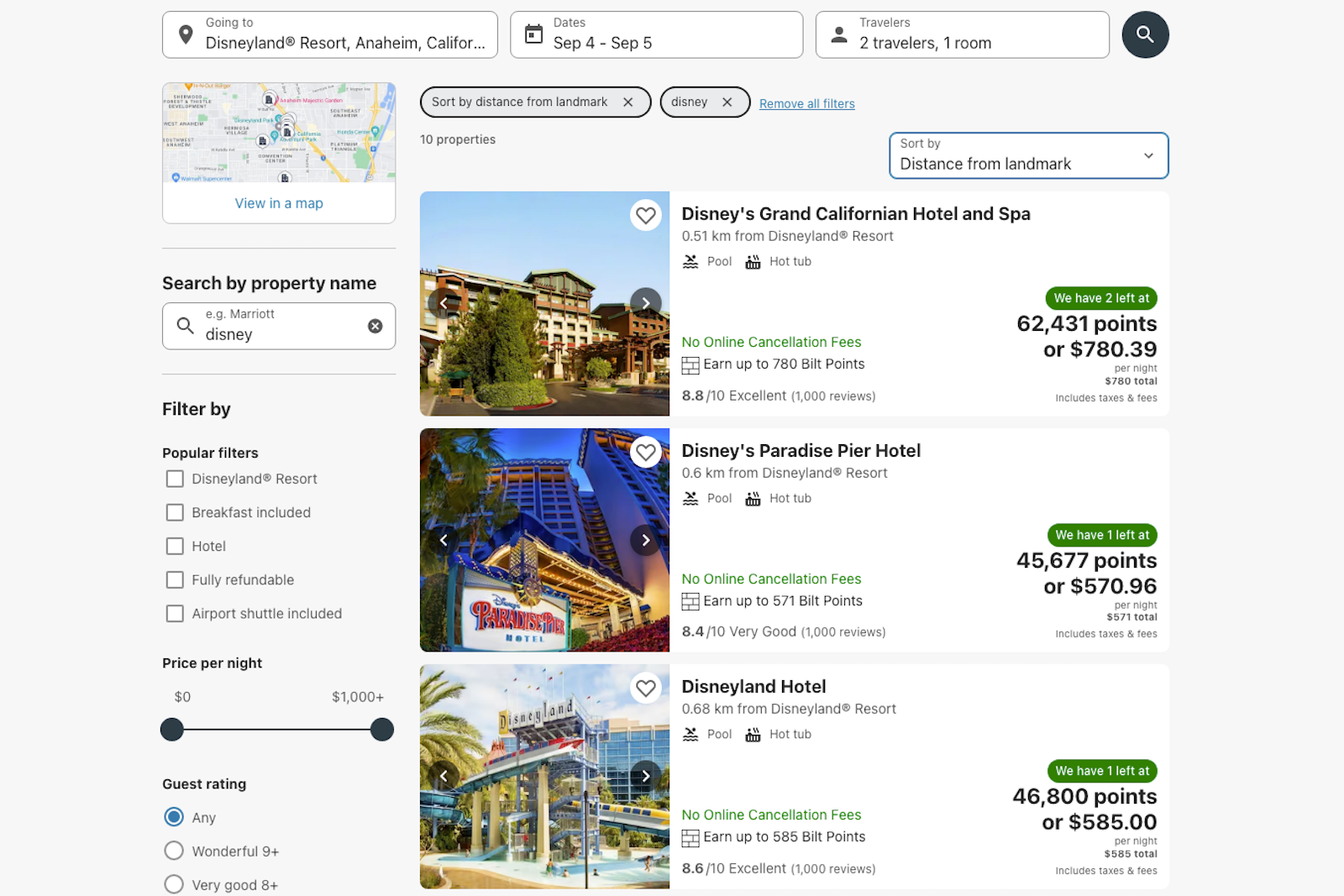

Bilt Rewards factors may be redeemed at a charge of 1.25 cents per level towards some Disney accommodations within the Bilt journey portal. See right here for particulars on rewards and advantages of the Bilt Mastercard®. Till lately, Bilt had Disney World accommodations in its journey portal, although it solely has Disneyland and Disneyland Paris choices. It is value checking to see if Disney World returns.

BILTREWARDS.COM

Moreover, you need to use different factors at a charge of 1 cent apiece for Disney accommodations in numerous journey portals.

This consists of the Citi Journey portal — with not solely the Citi Strata Premier Card but in addition no-annual-fee choices like Citi Double Money® Card (see charges and charges) and Citi Rewards+® Card (see charges and charges) — and Capital One Journey, utilizing miles at 1 cent apiece from playing cards just like the Enterprise X, Capital One Enterprise Rewards Credit score Card and Capital One VentureOne Rewards Credit score Card.

Greatest playing cards for Disney tickets

There are a number of methods to earn bonus factors in your Disney ticket buy, however how you purchase these tickets issues.

If shopping for tickets straight, the acquisition ought to code as leisure. Think about the Capital One Savor Money Rewards Credit score Card, which has no annual payment and earns 3% again on leisure purchases (see charges and charges).

If you do not have these playing cards, take into account the greatest bank cards for on a regular basis spending. These can present a very good return on spending, even and not using a bonus for leisure or theme parks.

*Worth of rewards relies on TPG’s October 2024 valuations and isn’t supplied by the issuer.

However what in case you do not buy your Disney theme park tickets along with your bank card? What in case you purchase them with a present card as an alternative?

Many workplace provide shops, warehouse golf equipment (similar to Sam’s Membership or Costco), Goal, grocery shops and even residence enchancment shops promote Disney reward playing cards. These might or is probably not on sale, however there are methods to make these purchases rewarding past simply gross sales.

With the Ink Enterprise Money® Credit score Card, you may get 5% again on the primary $25,000 spent at workplace provide shops and on web providers, cable providers and cellphone providers every cardmember yr (then 1% again). You may flip these earnings into Chase Final Rewards factors if in case you have a card that earns these factors.

Utilizing the American Specific® Gold Card, you may earn 4 factors per greenback in your first $25,000 in annual spending at U.S. supermarkets every calendar yr (then 1 level per greenback). That is an 8% return on spending, per TPG’s October 2024 valuations.

With both methodology, you may earn additional factors or money again when shopping for Disney reward playing cards; you need to use the reward playing cards to pay for park tickets.

Greatest playing cards for Disney meals

Fortunately, meals at on-property true eating places usually code as eating, triggering the eating places/eating class on bank cards which have it.

When you use a card with a journey bonus, pondering that might apply at a theme park, you will not earn additional factors. As an alternative, use a card that earns bonus rewards on eating purchases. Our favourite is the Amex Gold, because it earns 4 factors per greenback spent on eating places (as much as $50,000 in spending per calendar yr, then 1 level), so it is a sensible choice for Disney eating places.

Associated: One of the best bank cards for eating and eating places

How to decide on the very best bank card to your Disney trip

When selecting the very best card for Disney, there is not a cut-and-dry reply.

It is value stating that the precise bank card to your Disney journey may change throughout your journey, because it relies on what you are paying for and the place you might be paying.

Extra exactly, it relies on how that transaction codes in your bank card. The more than likely bonus classes for theme park tickets are leisure and journey.

Nonetheless, there are further prices that these playing cards won’t cowl. Think about your transportation to Anaheim, California or Orlando. You could want flights, fuel or a rental automotive, and it’s possible you’ll not have sufficient Rewards {Dollars} to cowl your lodging, meals and tickets.

The place you purchase Disney tickets issues

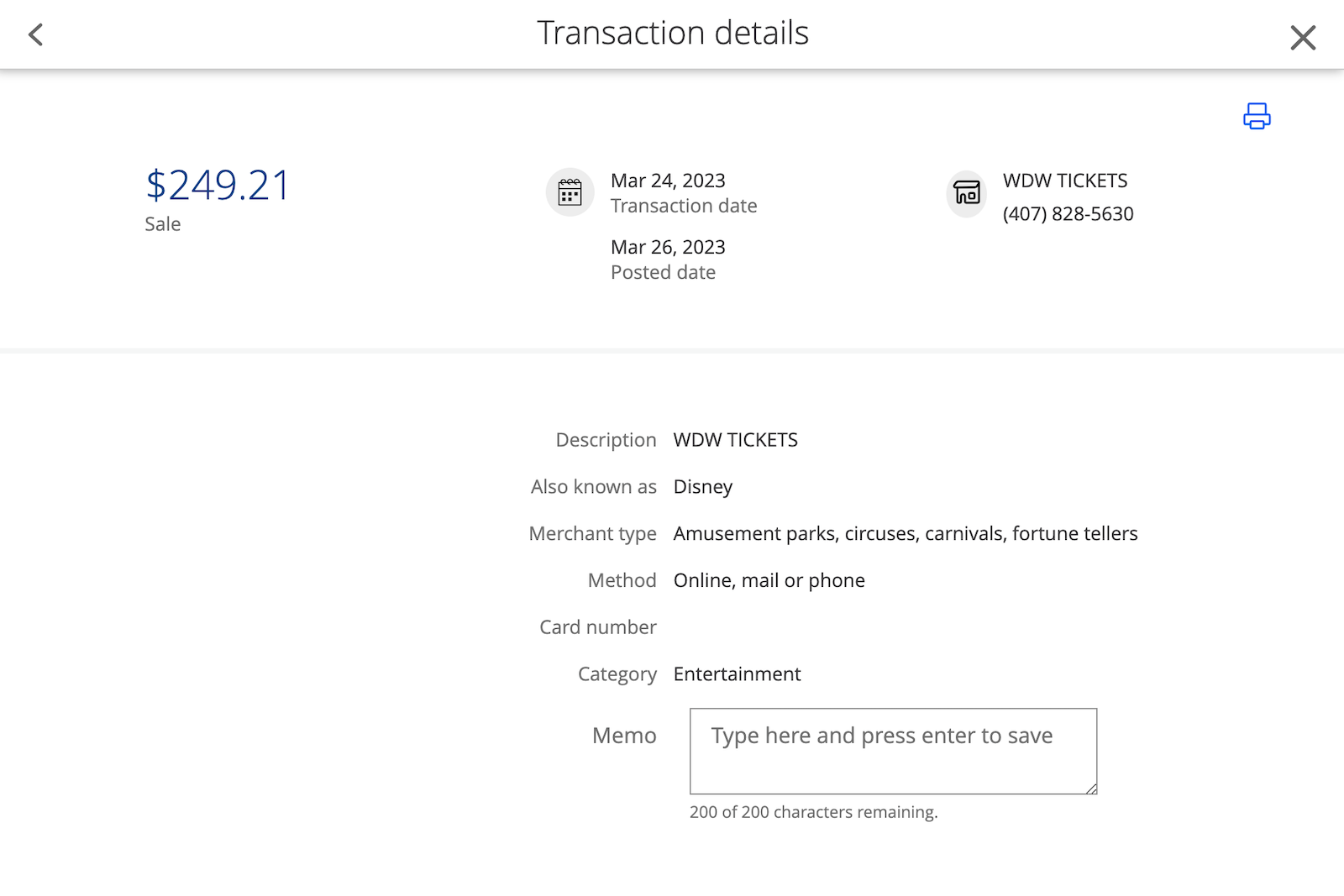

When buying park tickets straight from the theme park or Disney World annual passes, the cost needs to be coded as an leisure buy. On some bank cards, leisure will code as a journey cost, although that is not typical.

This buy of Disney tickets is coded as leisure.

Nonetheless, if you buy park tickets from a journey company (similar to Undercover Vacationer), cost them to your resort room or embrace them as half of a bigger trip bundle, the chances are excessive that the acquisition will code as a journey cost.

Why does this matter? When you pay with the Chase Sapphire Reserve and your $500 ticket buy codes as journey, you may earn 1,500 Final Rewards factors (3 factors per greenback on journey). If the acquisition codes as leisure, you may earn simply 500 factors (because the card would not have a bonus class for leisure).

The way in which the cardboard codes issues if you wish to use a few of its annual $300 journey credit score towards your buy.

Conversely, a reduce-the-wait Lightning Lane buy codes as leisure, so you must use your greatest bank card for leisure bills for that buy.

Do you need to use your bank card’s journey credit score at Disney?

If you wish to use the annual $300 Chase Sapphire Reserve journey credit score on a Walt Disney World or Disneyland journey, e-book a resort or hotel-and-tickets bundle straight with Disney or by way of a journey agent, similar to TPG’s companion Mouse Counselors.

If all you need is Disney theme park tickets, you need to use your journey credit score on purchases from a journey website like Undercover Vacationer as an alternative of buying straight from Disney. On this means, your buy ought to code as journey, triggering your Sapphire Reserve’s journey credit score.

The Capital One Enterprise X Rewards additionally gives a $300 annual credit score, however it’s worthwhile to e-book by way of Capital One Journey to make use of this perk. Fortunately, this website usually consists of Disney World accommodations in its reserving choices.

Two Citi bank cards even have credit that may knock down the prices of your subsequent Disney journey: the Citi Status (now not open to new candidates) and the Citi Strata Premier. Citi Strata Premier cardholders obtain a once-per-year $100 credit score for resort bookings of $500 or extra, excluding taxes and charges, booked on CitiTravel.com.

Citi Status cardholders can use their fourth-night-free perk twice a yr to e-book accommodations in Citi’s journey portal. Fortunately, most Disneyland and Walt Disney World accommodations seem on this portal.

Lastly, these with the Amex Platinum can use as much as $200 in resort assertion credit yearly for bookings with Wonderful Resorts + Resorts and The Resort Assortment (The Resort Assortment requires a two-night minimal keep). Choose Disney properties close to Disney World and Disneyland qualify, such because the JW Marriott Orlando Bonnet Creek, 4 Seasons Resort Orlando at Disney World and the Westin Anaheim Resort. Enrollment is required; phrases apply.

Do you need to redeem factors on Disney tickets?

Let’s begin with the dangerous information: Not all bank card factors work for a visit to Disney.

American Specific Membership Rewards factors aren’t very helpful for Disney tickets. Nonetheless, Bilt Rewards Factors, Capital One miles, Chase Final Rewards factors and Citi ThankYou factors are very helpful — although in several methods.

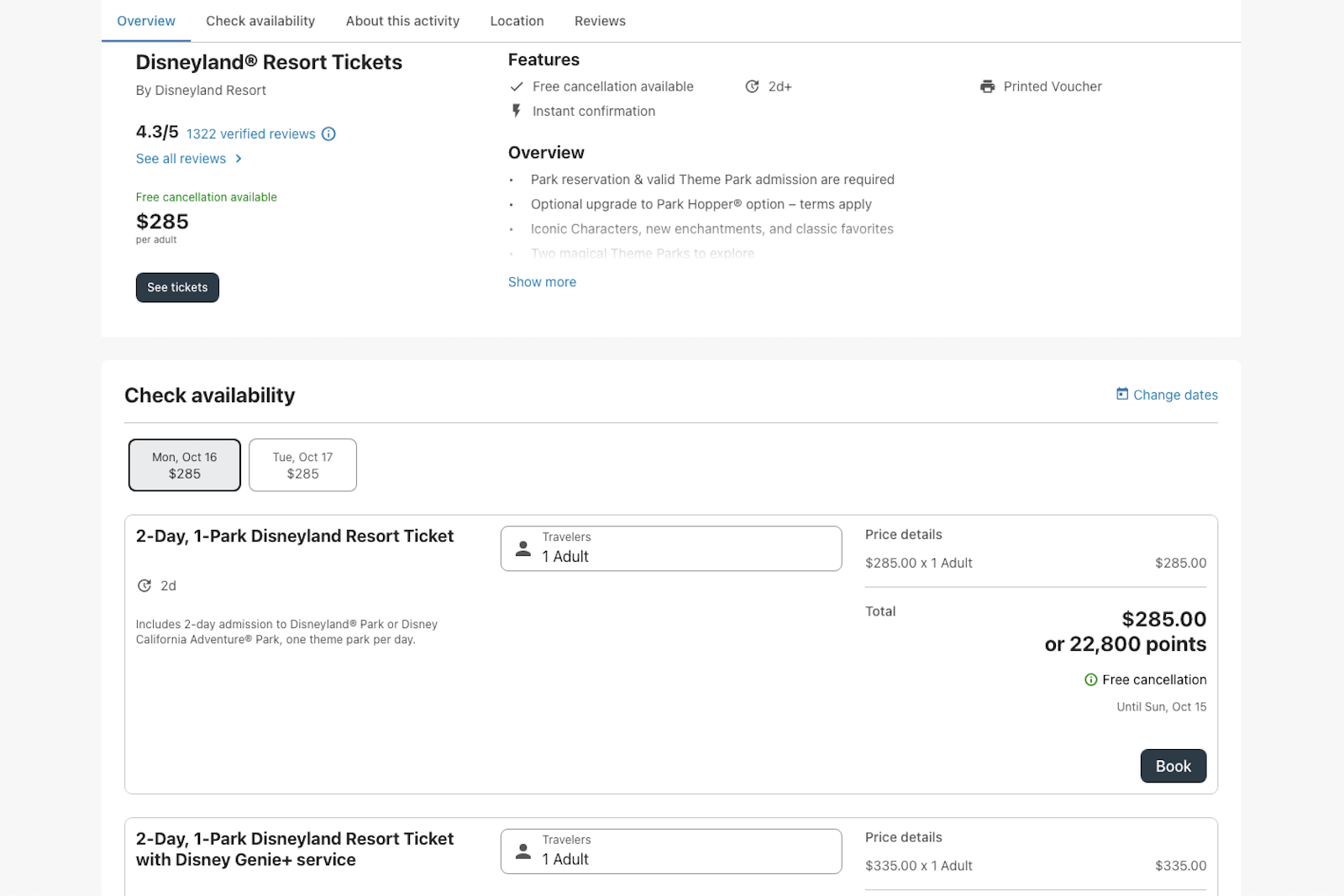

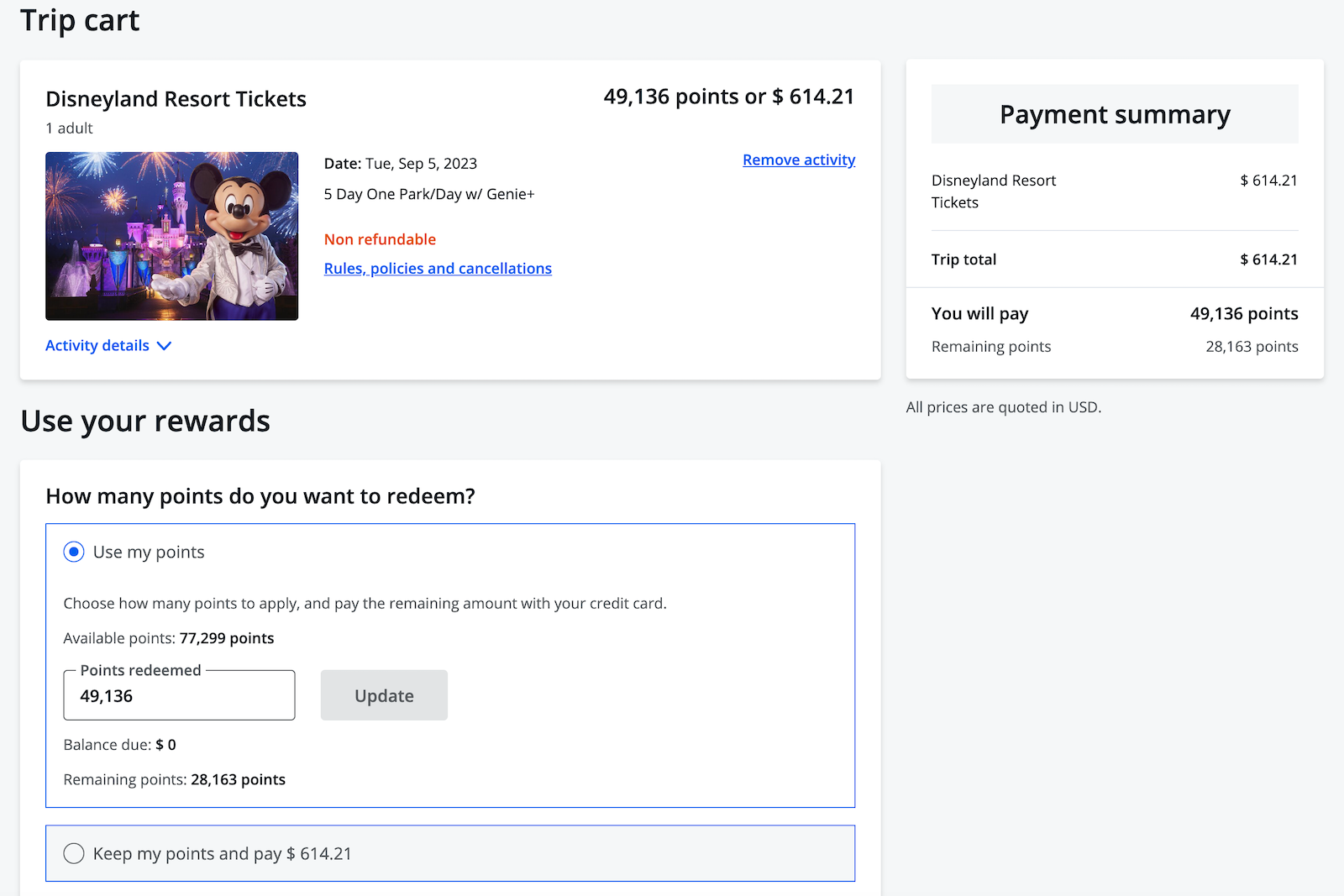

With Bilt Rewards, you’ll be able to e-book Disney tickets in its portal within the “Actions” part.

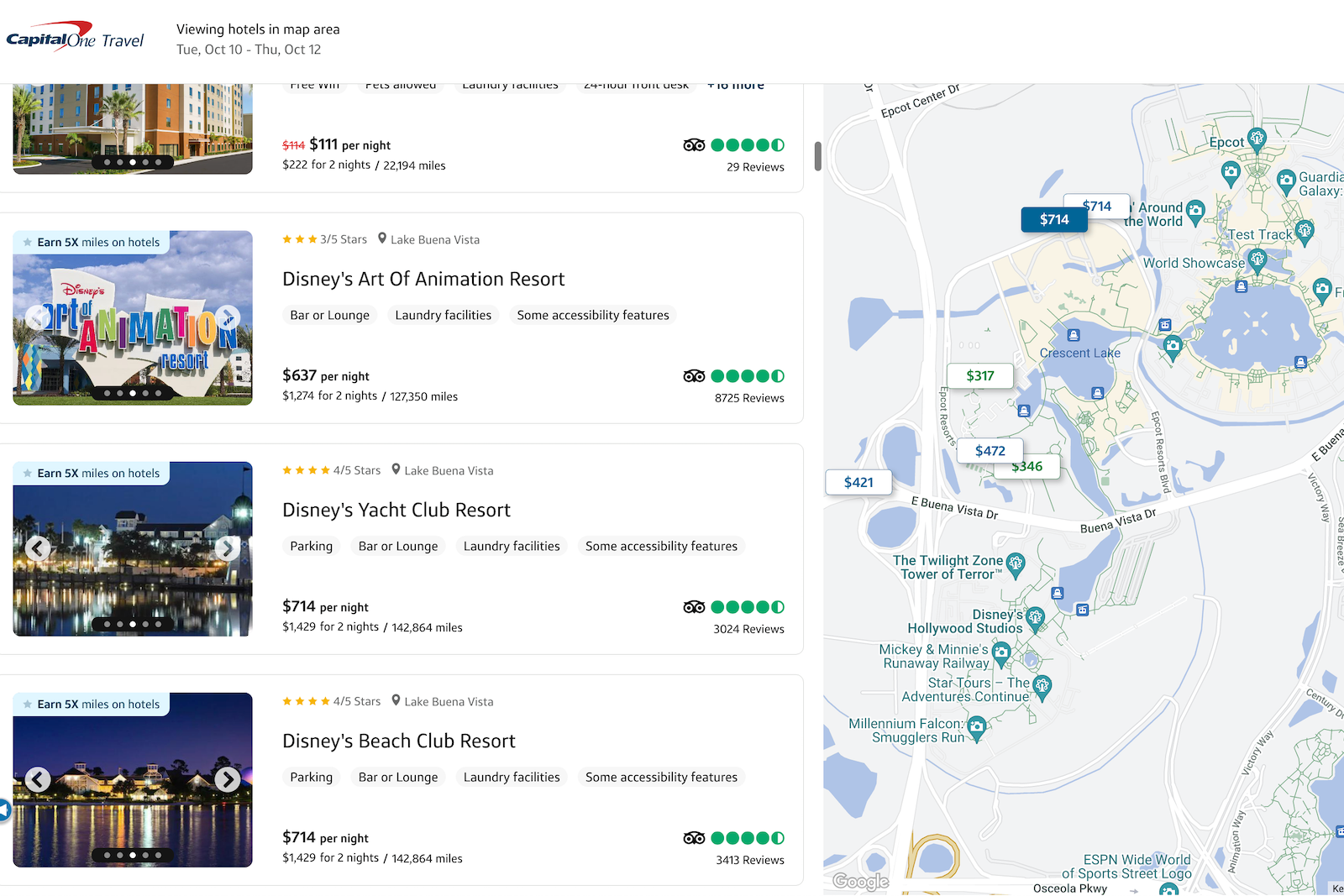

With Capital One Journey, you’ll be able to e-book Disney accommodations and pay with miles at a charge of 1 cent apiece. TPG senior author Tarah Chieffi was ready to make use of the Capital One miles she earned along with her Capital One Enterprise X to cowl three nights at Disney’s Yacht Membership Resort.

Nonetheless, since you need to use your miles to offset any journey cost in your card, it’s also possible to e-book straight with Disney or elsewhere (so long as it codes as journey) and use factors at a charge of 1 cent per mile to reimburse your self. The identical applies to reimbursing your self for journey purchases with Financial institution of America rewards factors.

You probably have Chase Final Rewards factors, you’ll be able to redeem these for Disneyland tickets however not Disney World tickets. The worth of your factors will differ from 1 to 1.5 cents apiece, relying on which card you may have (with the Sapphire Reserve fetching the very best worth).

You may as well hire Disney Trip Membership factors from a website like David’s Trip Membership to economize in your Disney lodging and use bank card factors to offset the expense. Moreover, most applications permit you to redeem factors for an announcement credit score to reimburse your self for purchases the place you could not pay with factors.

Clearly, Disney bank cards play a task right here, as effectively.

With the Disney Premier Visa Card, you may earn 2% again in Disney Rewards {Dollars} at Disney areas within the U.S.

You may redeem your Rewards {Dollars} for park tickets, resort stays and at shops and eating places on Disney properties. Redeeming your rewards to offset flights bought along with your Disney Premier Visa can also be doable. The cardboard has a $49 annual payment.

Can you utilize your Disney bank card wherever?

Disney bank cards can be utilized wherever main bank cards are accepted, together with Disney.

Constructing your individual Disney bank card technique

Disney Rewards {Dollars} can play an essential function in offsetting prices to your magical vacation. Nonetheless, sign-up bonuses from bank cards characterize the quickest method to earn massive sums of factors and miles — the categories that can be utilized to journey to Disney parks in methods Rewards {Dollars} cannot.

You probably have the time and wish the very best of all worlds, it might make sense to earn a few several types of bank card rewards to make use of towards your Disney journey.

Utilizing these questions as steerage, yow will discover the very best bank card for a Disney journey that your loved ones will love and your checking account will tolerate:

- What journey bills do you may have along with theme park tickets? The extra various your bills for a Disney journey, the extra transferable factors will show you how to.

- Are you prepared to remain off-property? If staying at a Disney-owned and -operated resort is obligatory, your technique will change. You may pay to your resort with factors if it is not a requirement.

- What bills are you able to pay for with factors upfront?

- What bills are you able to pay for after which offset with factors afterward?

Associated: A magical information for how you can plan a visit to Disney World this yr

Backside line

Choices abound for utilizing bank card factors and miles to pay for numerous parts of your Disney journey. That is excellent news, contemplating how costly these holidays may be.

If you wish to make a giant dent in the price of your journey, you is probably not on the lookout for the very best Disney bank card however reasonably the very best bank card for Disney. A mixture of factors, free nights and reductions from the above methods might help defray prices when planning your loved ones’s subsequent journey to Disneyland or Walt Disney World, making all of it really feel additional magical.

Associated:

For Bilt Mastercard charges and charges, click on right here.

For Bilt Mastercard rewards and advantages, click on right here.