As we shortly strategy the vacation season, you could already be within the means of discovering the excellent presents to your family members. Nonetheless, in case you are a journey rewards fanatic, there is a vital choice you want to make relating to these purchases. You will need to decide whether or not it is best to pay for presents immediately or along with your factors and miles, thus holding cash in your pocket. Each approaches have benefits and downsides, together with potential pitfalls to keep away from.

Everybody has their very own technique for maximizing the worth of bank cards, factors, and miles. Some people would by no means contemplate redeeming them for presents, as they like to save lots of their rewards for flights or high-end lodge stays. Others view these rewards as a type of foreign money and primarily use them to scale back on a regular basis bills. In the end, for those who spend responsibly this vacation season, there isn’t a flawed method to strategy your buying.

Now, let’s delve into learn how to take advantage of your vacation purchases so it can save you cash.

Select the correct bank card(s)

Throughout the vacation season, you may wish to make sure you use the correct bank card(s) to your purchases. Nonetheless, it is vital to notice that there is not a common “excellent” bank card for everybody. The perfect alternative will fluctuate based mostly in your way of life and priorities.

In case you have not too long ago acquired a brand new bank card with a welcome bonus, it needs to be your main possibility for vacation buying. Following that, contemplate playing cards that supply bonus rewards for the precise locations the place you propose to buy this yr.

Earn a bonus on a brand new card

In case you have a substantial quantity to spend on vacation buying, now could be an opportune second to contemplate making use of for certainly one of the highest journey rewards playing cards.

Most playing cards require a certain amount of spending throughout the preliminary few months to unlock the welcome bonus, and a few playing cards even waive the annual charge for the primary yr.

When you’ve been reluctant to use for a card attributable to considerations about assembly the spending requirement, the vacation season — with its accompanying bills — presents an ideal alternative to open a brand new card. When you’re seeking a brand new addition to your pockets, listed below are three playing cards that at the moment provide interesting welcome gives:

Day by day Publication

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Associated: Acquired a brand new bank card? Suggestions that can assist you earn your welcome bonus

Use a card with bonus rewards on vacation spending

One other strategy is to make use of a bank card that gives bonus rewards with in style retailers for vacation buying. Listed here are a number of the high playing cards to contemplate to your vacation purchases:

- Chase Freedom Flex®: This card with rotating classes offers 5% money again on as much as $1,500 spent within the fourth quarter of 2024 at PayPal (amongst different classes), so long as you activate by Dec. 14, 2024. Since many on-line retailers provide PayPal as a fee processing technique, you should utilize this card to get bonus money again on all kinds of vacation purchases. Though that is categorized as a cash-back card, you may mix your earnings with factors out of your Chase Sapphire Most popular® Card, Chase Sapphire Reserve® or Ink Enterprise Most popular Credit score Card to acquire absolutely transferable Final Rewards factors.

- Uncover it® Money Again: By activating this card’s present bonus classes between now and Dec. 31, you may earn 5% money again on as much as $1,500 spent within the fourth quarter of 2024 at Amazon and Goal (then 1% money again).

The knowledge for the Uncover it Money Again has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Associated: Issues to contemplate to your vacation buying bank card technique

Add a certified person

Including an approved person to a bank card account gives quite a few benefits. Firstly, it aids the first cardholder in assembly the welcome bonus spending necessities and accelerates the buildup of rewards. Moreover, approved customers can leverage the first cardholder’s credit score rating and credit score historical past, which regularly results in improved credit score scores.

Furthermore, some bank cards present extra advantages to approved customers, together with entry to airport lounges and assertion credit for World Entry or TSA PreCheck functions.

Associated: Bank cards with the best worth for approved customers

Why it is best to keep away from retailer playing cards

Whereas the methods above can assist you maximize your rewards on vacation purchases, there may be one tactic it is best to keep away from: making use of for retailer bank cards. As you store on-line or in-store this vacation season, you could obtain gives from retailers to open a brand new retailer card account. These gives may be tempting, particularly after they promise an prompt low cost of 10% or 20%, together with ongoing rewards.

Nonetheless, it’s usually not price getting a retailer bank card. Making use of for one normally leads to a onerous inquiry in your credit score report, which might negatively influence your credit score rating. It should additionally most likely be thought of a new account by most card issuers, which might have penalties sooner or later. Furthermore, the low cost you obtain from a retailer bank card is unlikely to match the worth of a welcome bonus supplied by a brand new journey rewards card.

For example, if a retailer card offers you a 20% low cost on a $1,000 buy, you’d save $200. Whereas this will likely appear important, one of the best rewards bank cards can give you greater than $1,000 in worth from the welcome bonus alone. Retailer playing cards additionally have a tendency to supply subpar rewards to your spending in the long term.

Nonetheless, it could be price enrolling in store-specific loyalty applications (that are normally free), particularly for those who plan to proceed buying at these retailers. Though these applications could present higher rewards to holders of their respective retailer bank cards, becoming a member of them can nonetheless be a comparatively easy method to enhance your rewards.

Associated: Why you should not open a retailer bank card through the vacation season

Use on-line buying portals

You will most likely be doing lots of your vacation buying on-line. Fortuitously, there are a lot of methods to take advantage of on-line purchases.

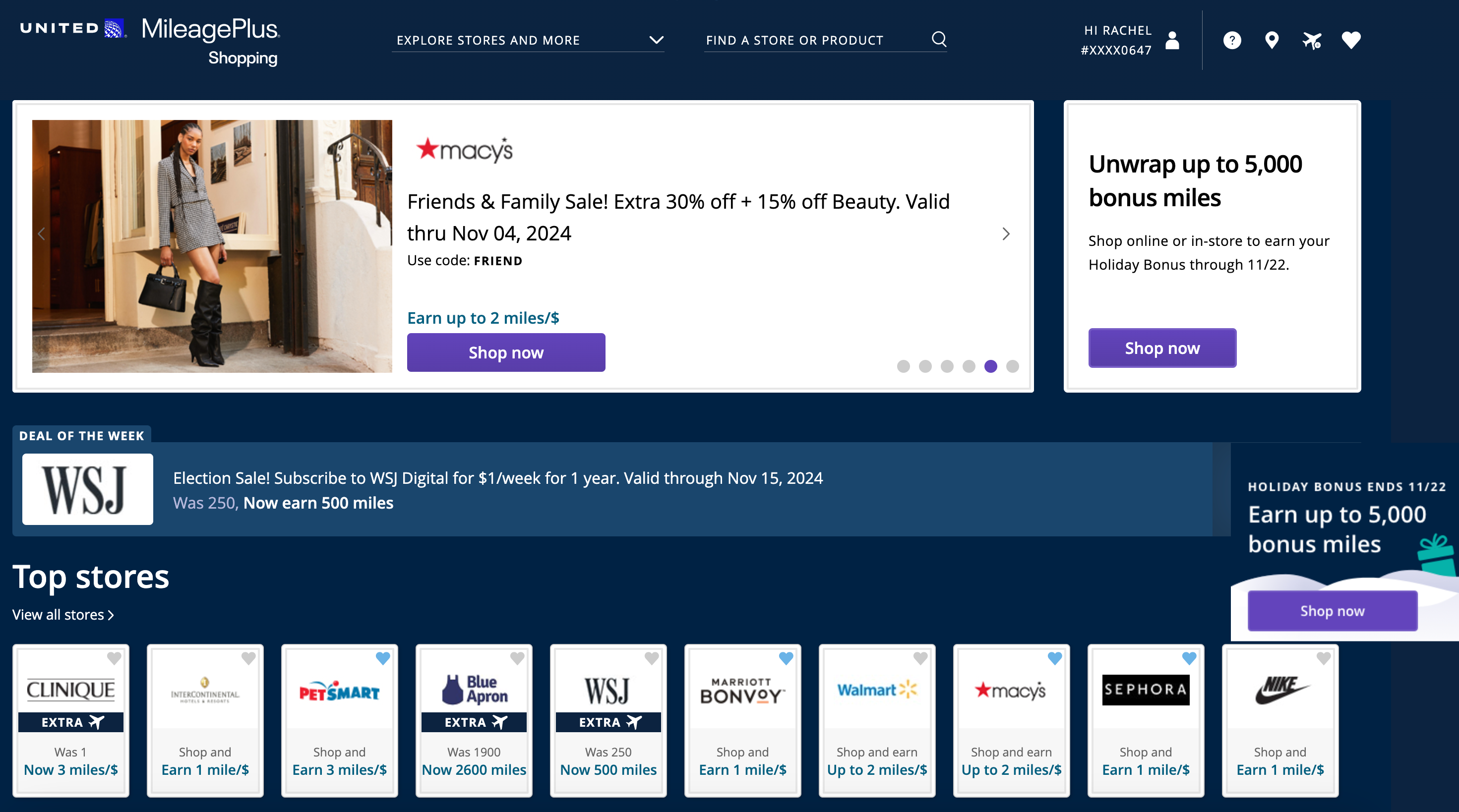

One among our favourite methods lets you earn bonus factors, miles or money again on varied on-line transactions, on high of the rewards you’d earn with the bank card you employ to pay. We’re speaking about buying portals, and most airline and bank card reward applications have one.

All you want to do is begin on the portal as an alternative of going on to the vendor’s web site. Generally, you may even set up a buying portal extension to your browser. Many in style on-line retailers, together with Goal, Dwelling Depot and Macy’s, take part in these portals. It is a fast and practically pain-free method to enhance your earnings this vacation season.

Standard on-line buying portals embrace:

When selecting which buying portal to make use of, contemplate which rewards are most precious. Additionally, understand that though many of those portals are run by the identical firm (and thus look the identical), the payouts can differ. Fortuitously, there’s a simple method to shortly evaluate incomes charges: Use a buying portal aggregator like Evreward or Cashback Monitor. These websites present a side-by-side comparability of the bonuses you may earn throughout these portals, so that you needn’t fireplace up every one individually each time you make a web-based buy.

Many portals run seasonal bonuses across the holidays to make the rewards you may earn in your vacation buying spree even sweeter. These sometimes present a set variety of factors if you meet a complete spending requirement throughout all retailers. For example, the United buying portal is at the moment providing 500 bonus miles if you spend $150, 2,000 miles if you spend $600 or 5,000 miles if you spend $1,200. Maintain a watch out for these offers as we head into the vacation season. (Be aware that this provide ends on Nov. 22.)

Associated: The newcomers information to airline buying portals

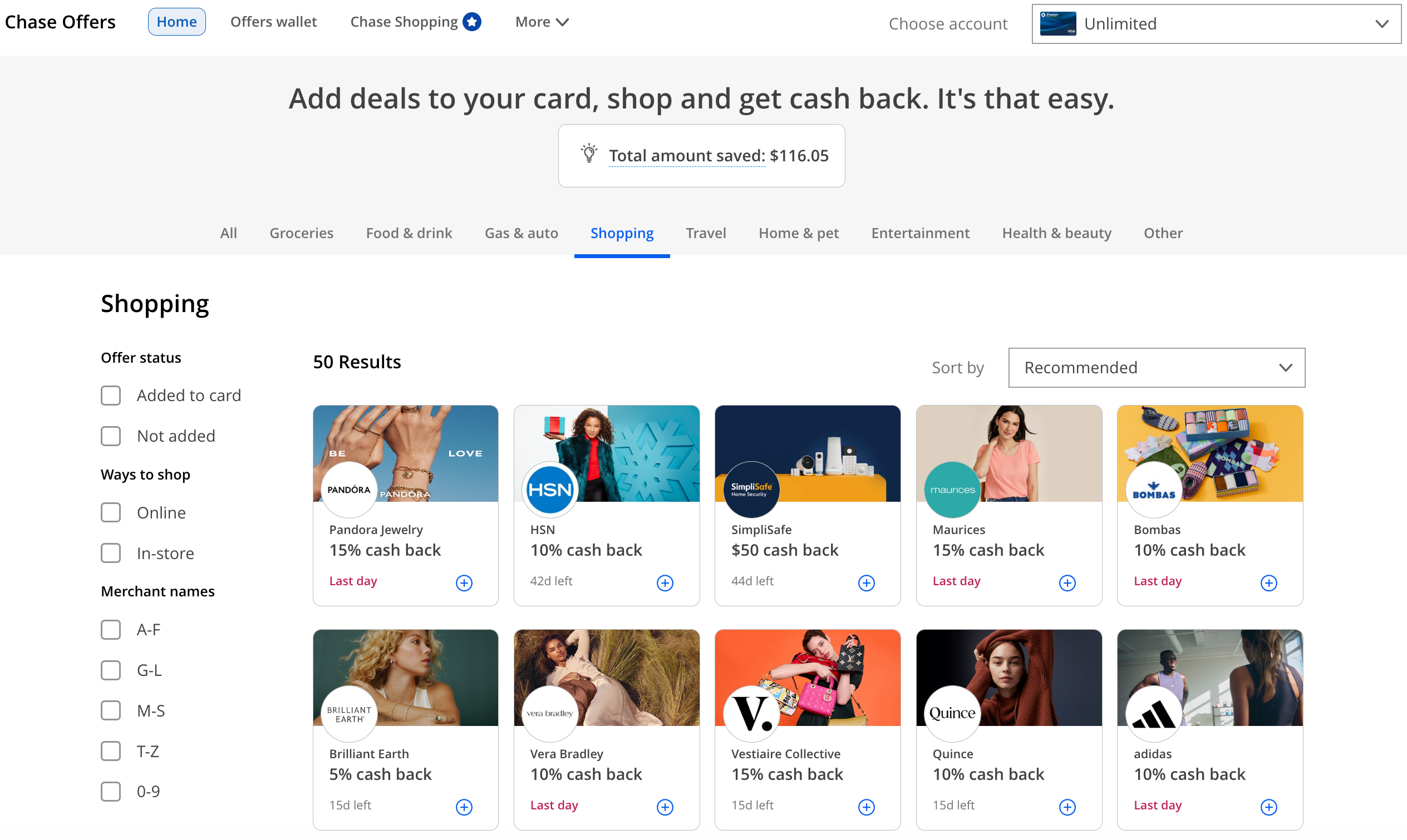

Use bank card perks and gives

Some premium playing cards provide assertion credit that may prevent cash at choose retailers. For example, for Amex Platinum cardholders, you obtain as much as $100 in Saks Fifth Avenue assertion credit each calendar yr — as much as a $50 credit score is awarded from January to June, and one other as much as $50 credit score is given from July to December. (Enrollment is required.)

Some card issuers, like Amex and Chase, run focused gives to provide you money again on varied purchases. These fluctuate broadly from one buyer and card to a different. It is all the time price seeing what gives can be found to you through the vacation season. By combining bank card gives with earnings from on-line buying portals, you may obtain some spectacular reductions in your vacation buying.

Simply do not forget that these gives sometimes require activation. You will need to activate the provide in your card, then use the identical card to make the acquisition inside the timeframe specified to earn the money again.

Associated: Your information to the Amex Platinum Saks Fifth Avenue credit score

Get one of the best buy safety

Are you buying a high-priced present like an iPhone 16 this vacation season? In that case, utilizing the correct bank card to purchase your big-ticket merchandise can prevent cash down the highway. That is as a result of some playing cards cowl you with buy safety.

Buy safety can prevent from the prices of repairing or changing broken, stolen or misplaced objects. Nonetheless, not all bank cards provide this profit, and the protection can fluctuate by your state of residence. Simply keep in mind to verify the precise phrases, such because the time interval lined and the declare course of, in addition to the utmost protection quantity supplied by your bank card.

Listed here are a couple of in style playing cards with this profit:

* Eligibility and profit ranges fluctuate by card. Phrases, circumstances and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by AMEX Assurance Firm.

Associated: How an often-overlooked bank card profit put $1,400 again in my pockets

Use factors and miles for vacation purchases

Slightly than paying for presents this yr, you could be seeking to redeem your factors or miles for these purchases. This will make sense if you wish to decrease out-of-pocket bills or have many reward factors and miles saved up — particularly for those who aren’t touring this vacation season.

Though you may usually get extra worth from journey redemptions, most loyalty applications provide quite a few methods to redeem your rewards for merchandise and present playing cards. Here is a rundown of the main applications.

American Specific Membership Rewards factors

American Specific Membership Rewards factors are price 2 cents every based mostly on TPG’s November 2024 valuations. Nonetheless, usually, you may be fortunate to obtain even half that worth if you redeem your factors for present playing cards or merchandise. You will solely obtain 0.5 cents per level when selecting American Specific present playing cards, and redeeming for different present playing cards will typically lead to values between 0.7 cents to 1 cent per level.

You may also use your Membership Rewards factors to pay with factors at checkout when buying with choose on-line retailers. One among these retailers is Amazon, the place your factors are price 0.7 cents. That mentioned, there are sometimes promotions the place you may save utilizing Amex factors.

Associated: Tips on how to redeem factors and miles for Amazon purchases

Chase Final Rewards factors

Chase Final Rewards factors are price 2.05 cents every, in line with TPG’s November 2024 valuations. You will sometimes get about half that if you redeem for present playing cards, merchandise and different nontravel choices. Most retail present card awards have a price of 1 cent per level, however Chase generally runs gross sales on sure retailers, providing you a reduction of 10% and elevating the worth barely to 1.1 cents per level.

You may also use your Final Rewards factors to store immediately with Amazon and PayPal, however you may solely obtain 0.8 cents per level. Not solely is redeeming Chase factors by means of Amazon a poor worth proposition, however a compromised account may wipe out your Chase stability.

Lastly, Chase Pay Your self Again is a worthy choice to redeem factors for an announcement credit score. This characteristic is obtainable on all Final Rewards-earning playing cards and lets you redeem factors to offset purchases you’ve got already made. You will get a price of 1 cent every on most purchases, however promotional classes and retailers can give you a greater worth of as much as 1.5 cents apiece.

Associated: From worldwide enterprise class to home hops: 6 of one of the best Chase Final Rewards candy spots

Citi ThankYou Rewards factors

Citi ThankYou Rewards factors are price 1 cent every when redeeming towards present playing cards and 0.8 cents every towards Store with Factors at Amazon. Alternatively, you may rise up to 1 cent per level when redeeming towards money again, relying in your card. This is not a perfect redemption, contemplating Citi ThankYou factors are price 1.8 cents every, in line with TPG’s November 2024 valuations.

Citi Strata Premier℠ Card (see charges and costs) cardholders would doubtless be higher off transferring factors to certainly one of Citi’s switch companions. When you switch your factors to an airline or lodge associate, you will get lots of worth if you redeem for last-minute awards or premium experiences. You may also switch your ThankYou factors to every other ThankYou Rewards member totally free, which may make an important present.

Associated: Tips on how to redeem Citi ThankYou Factors for optimum worth

Capital One miles

Capital One miles can be utilized to cowl earlier journey purchases at a charge of 1 cent every, however you may’t use them to cowl nontravel purchases this manner. You may redeem them immediately by means of Amazon or PayPal or for quite a lot of present playing cards, however they’re going to solely be price 0.8 cents per mile. Evaluate this to TPG’s November 2024 valuations, which peg Capital One miles at 1.85 cents every.

So you may usually be a lot better off transferring your Capital One miles to lodge or airline companions. You may also share your Capital One miles with anybody so long as they’ve a miles-earning account, akin to one of many Capital One Enterprise playing cards or Spark playing cards.

Bilt Rewards Factors

When you maintain the Bilt Mastercard® (see charges and costs), your Bilt Factors can be utilized to cowl Amazon purchases. Whereas you should utilize your Bilt Factors to cowl all or a part of your Amazon purchases, you may solely obtain a redemption worth of 0.7 cents per level. That is nicely under TPG’s November 2024 valuation, which values Bilt factors at 2.05 cents per level.

Wells Fargo Rewards factors

Wells Fargo Rewards factors may be redeemed for 1 cent per level for journey purchases. If you wish to buy present playing cards along with your reward factors, you are able to do so at a price of 1 cent per level for many retailers. Plus, Wells Fargo Rewards can also be providing extra promotions, akin to 10% off when redeeming factors for present card purchases with choose retailers, together with Apple, Dwelling Depot, Ulta and extra. This provides you a price of 1.11 cents per level.

Although you will get a redemption worth of 1.11 cents per level for choose present playing cards, TPG values Wells Fargo Rewards factors at 1.6 cents per level (per our November 2024 valuations). Subsequently, to maximise your reward factors, leveraging Wells Fargo’s journey switch companions would make it easier to get essentially the most worth.

Associated: 7 causes to get the Capital One Enterprise Rewards Credit score Card

Airline and lodge applications

Many airline and lodge loyalty applications provide the power to redeem rewards for merchandise and present playing cards, however you may nearly all the time obtain inferior worth in comparison with journey rewards.

Associated: Maximizing factors and miles to beat inflation and lower your expenses

Must you do it?

When you’ve gotten the choice of transferring bank card rewards to airline miles or lodge factors, as you do with American Specific Membership Rewards, Capital One miles, Chase Final Rewards and Citi ThankYou Rewards, you may come out far forward of any merchandise or present card choices by way of redemption worth. Nonetheless, when switch choices do not exist, you could possibly get the identical worth when redeeming your rewards for present playing cards or merchandise. Alternatively, gifting factors might also be an excellent possibility.

It is as much as you the way you wish to redeem your factors. For many individuals, it is extra profitable to save lots of factors for award journey and pay for presents out of pocket. Nonetheless, in case your rewards balances are overflowing otherwise you worth the money financial savings of redeeming for merchandise or present playing cards, be at liberty. Because the saying goes, worth is within the eye of the beholder.

Associated: Why transferable factors and miles are price greater than different rewards

Think about giving the present of journey

Do not forget that most (however not all) loyalty applications allow you to e-book journey for others, too. Spending your hard-earned miles to ship a good friend or member of the family on a visit could be the final word present you may give this vacation season.

Whilst you may present factors and miles to a liked one, you may as well e-book a visit for them on factors. This will provide you with extra worth out of your factors and save the one you love the hassle of planning their itinerary.

So, for those who’re flush with factors and miles, contemplate reserving your college-aged cousin on their subsequent round-trip ticket dwelling from faculty or treating your dad and mom to their first worldwide business-class ticket. No matter it could be, you are giving the present of journey to those that could not have the assets to do it independently.

To purchase a ticket for another person, e-book an award journey as regular and easily add the present recipient’s title and knowledge on the checkout display screen. They will then verify in for his or her flight and take off — even for those who’re not accompanying them.

Associated: Tips on how to give the present of journey

Backside line

There are lots of methods to take advantage of your vacation purchases this yr. Most applications present easy methods to redeem factors and miles on presents to your family members, however you may usually get extra worth from transferring factors to associate applications or redeeming them immediately for journey purchases. When you resolve to pay money and earn rewards in your vacation buying, remember to use the guidelines outlined above to maximise your return.

For Capital One merchandise listed on this web page, a number of the advantages could also be supplied by Visa® or Mastercard® and will fluctuate by product. See the respective Information to Advantages for particulars, as phrases and exclusions apply.

See Bilt Mastercard charges and costs right here.

See Bilt Mastercard rewards and advantages right here.