12 months to this point, U.S. resort efficiency has are available in a bit weaker than projected with demand virtually flat (+.1 p.c) and RevPAR progress at +1.1 p.c. With modest provide progress pushing occupancy comparisons to unfavorable territory (–.5 p.c), there was much less alternative to drive whole revenues as whole income per out there room (TRevPAR) is down .3 p.c.

After three consecutive months of slower labor progress, labor prices are again on the rise with a 5.7 p.c enhance in labor per out there room (LPAR). Decrease TRevPAR and better working bills (particularly labor) have led to exaggerated declines in gross working revenue per out there room (GOPPAR), which is down 8.9 p.c.

One noteworthy optimistic within the metrics is group enterprise performing above final yr with a continuation of the bifurcation development that has been enjoying out. Higher upscale and upscale chains have grown RevPAR by greater than 1 p.c, whereas progress for luxurious chains (+.2 p.c) has been extra muted. Improved demand for teams has meant extra income alternative exterior of the rooms division, particularly meals & beverage.

Whole F&B revenues are up 1.4 p.c in comparison with final yr and at the moment sit at 106.9 p.c of 2019 ranges. When accounting for inflation, F&B revenues are at 87.9 p.c of 2019 ranges. The most important F&B income progress has been with different F&B, which has elevated 7.6 p.c on a PAR foundation and consists of non-consumable F&B objects like A/V prices and room leases. Meals gross sales PAR has realized the second highest progress at +6.4 p.c. Nevertheless, with progress in revenues comes progress in bills, which have risen at a a lot sooner fee than revenues. Whole F&B bills PAR had been up 9.6 p.c yr over yr, with the most important contributor being labor (+5.1 p.c).

Specializing in simply full-service properties within the luxurious, higher upscale, and upscale courses, F&B revenues PAR are up 7.5 p.c yr over yr, whereas bills are up solely 3.4 p.c. The upper-upscale class has realized the most important progress yr over yr in revenues PAR (+5.8 p.c), boosted primarily by robust progress in different F&B (+7.7 p.c) and meals (+6.6 p.c).

Though there’s constant robust progress amongst F&B revenues for these three courses, progress charges are stronger on the expense aspect and have restricted the chance for margin progress. Margins for these courses are a mean of 1.6 factors decrease than 2019 and 1.7 factors decrease than 2023. Once more, labor is enjoying a serious function in decrease margins as F&B labor for these three courses is up $10 per occupied room (POR), which is a 26.3 p.c enhance since 2019.

Prime 25 Markets

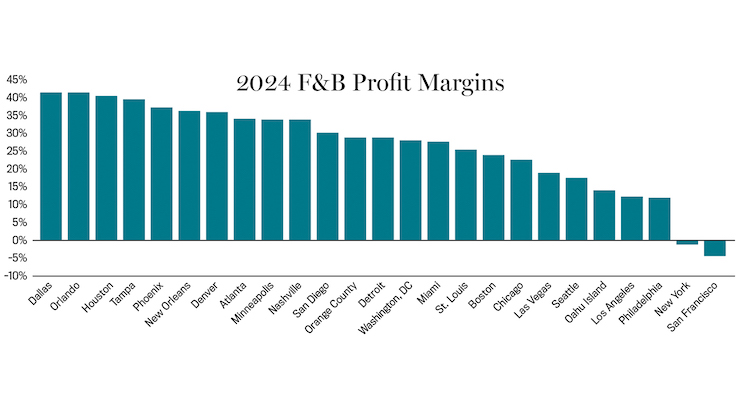

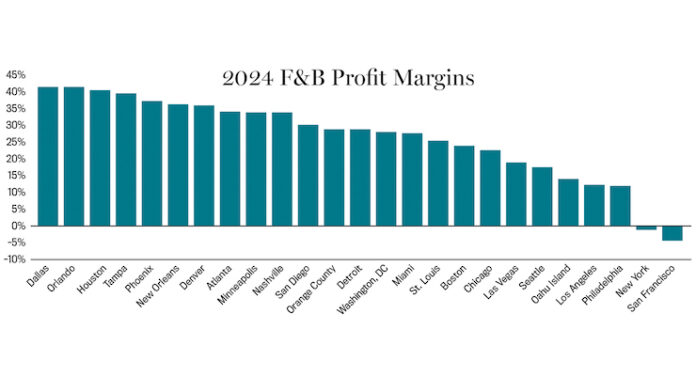

A lot of the labor stress tends to return from greater markets, and though the Prime 25 Markets have been outperforming all different markets, their bills are inclined to mirror that greater demand. F&B revenues PAR within the Prime 25 Markets is up 4.4 p.c for all properties and 6.1 p.c for full-service properties, whereas their bills are up 8.5 p.c and 6.9 p.c, respectively. Dallas, Atlanta, and Nashville are realizing the best progress in F&B revenues, whereas San Francisco, New York Metropolis, and Philadelphia are reporting the bottom F&B revenue margins. Solely eight of the Prime 25 Markets are realizing greater revenue margins than final yr.

The Want for Creativity

In any business, stress drives creativity, and the resort business is not any exception. Motels have been getting extra environment friendly at making a eating expertise for visitors that can be aware of margins. Know-how is one device on this effort, and resorts are utilizing it to scale back waste, enhance scheduling, and alleviate stress on employees. Moreover, resort eating places are elevating the eating expertise to draw high-end resort visitors and locals. Together with this effort, they’re curating their menu and downsizing choices to allow them to deal with offering one of the best eating expertise potential in hopes of driving revenue margins.