Chase Final Rewards factors are the foreign money of most Chase-branded bank cards. You’ll be able to earn Chase Final Rewards factors for on a regular basis spending after which redeem them for a variety of rewards.

Regardless of growing competitors from American Categorical Membership Rewards factors, Citi ThankYou Rewards factors and Capital One miles, Chase Final Rewards factors have maintained their place as one of the vital worthwhile and helpful factors currencies — particularly with worthwhile rewards playing cards just like the Chase Sapphire Reserve®, Chase Sapphire Most well-liked® Card and Ink Enterprise Most well-liked® Credit score Card.

Transferring Final Rewards to journey companions is usually probably the most worthwhile technique to redeem your hard-earned factors. With 14 completely different switch companions, you’ve got loads of choices since you may preserve your Chase factors in your Final Rewards account till you may switch them.

Right here is every little thing to find out about Chase Final Rewards’ switch companions.

Associated: One of the best Chase bank cards

Who’re the Chase switch companions?

You’ll be able to switch Final Rewards factors to 11 airline applications:

Chase additionally companions with three lodge applications:

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

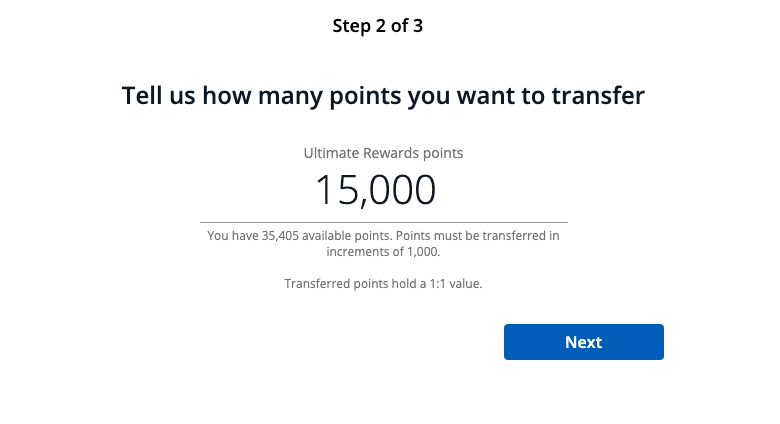

All switch ratios are 1:1 (although there are occasional switch bonuses), and it’s essential to switch factors in 1,000-point increments.

How lengthy do Final Rewards transfers take?

Most transfers from Chase Final Rewards to its accomplice applications are instantaneous. Nonetheless, in our most up-to-date testing, transfers to Singapore Airways KrisFlyer took about 48 hours.

Notice that switch bonuses may also be inconsistent. For instance, when TPG’s senior editorial director Nick Ewen transferred factors to Aeroplan to reap the benefits of a 20% bonus, the bottom factors arrived instantly, but it surely took three days for the bonus factors to publish to his account.

Whereas most transfers by way of the Chase portal needs to be instantaneous, delays can occur when transferring your factors. To assist with the switch course of, we suggest ensuring that the identify in your Final Rewards account matches that in your loyalty program account. Moreover, be sure you have signed up with a loyalty program prematurely, as a brand new account may additionally trigger a delay within the switch course of.

How do I switch Chase factors to companions?

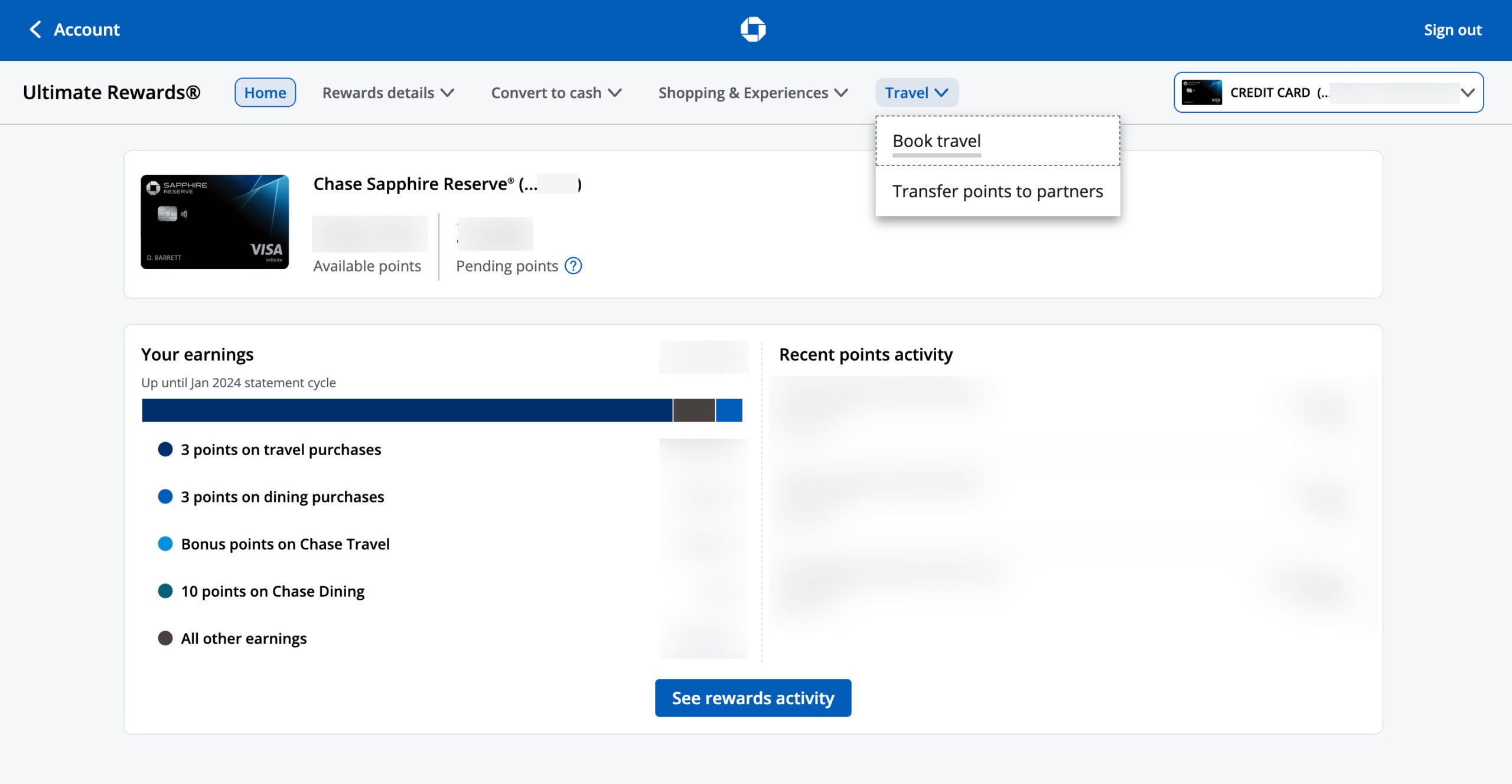

You’ll be able to simply switch Chase factors on-line. First, log in to your Chase account and navigate to the Final Rewards portal. Below the Journey drop-down, choose “Switch to Journey Companions” to entry the primary switch web page.

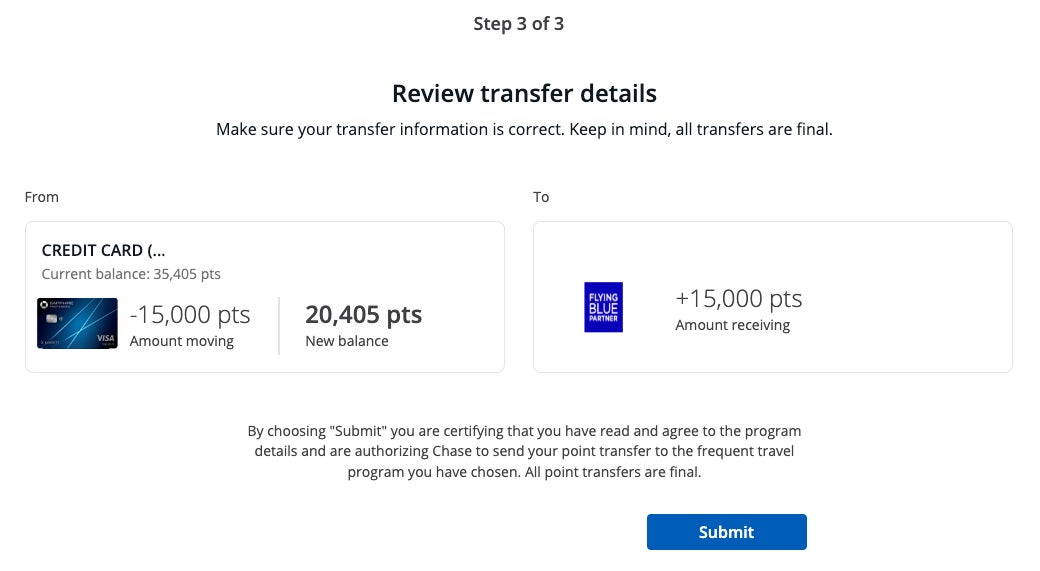

You’ll then see the checklist of switch companions and any present switch bonuses. Choose your required switch accomplice, hyperlink your exterior account when you have not already carried out so, choose the variety of Final Rewards factors you want to switch after which submit the switch.

Bear in mind, Final Rewards transfers can’t be reversed, so it is best to attend till you’ve got a selected use earlier than transferring them.

What are one of the best Chase switch companions?

Given the low award chart charges of the World of Hyatt program, many TPG staffers consider Hyatt is one of the best lodge switch possibility for redeeming Final Rewards factors.

When you would favor to switch to one of many 11 completely different airline program companions, the best choice might rely upon which airways fly to and from the locations you want to journey, who this system companions with and which airways you prefer to journey with.

There are candy spots to be present in most airline switch choices, particularly these applications which have retained award charts.

Listed below are a few of our favourite Final Rewards candy spots.

Prime-tier Hyatt resorts

The World of Hyatt award chart has two interesting elements. First, its mere existence is notable, given most different lodge applications (together with IHG One Rewards and Marriott Bonvoy, the opposite Chase lodge companions) have shifted to dynamic pricing.

Past that, Hyatt’s award charges could be extremely low in comparison with some rivals. You’ll be able to e book among the fanciest Park Hyatt properties in the complete portfolio, together with the Park Hyatt New York and Park Hyatt Sydney, for simply 35,000 factors per night time throughout off-peak dates. TPG values Hyatt factors at 1.7 cents every (per our October 2024 valuations), so 35,000 factors are price $595.

That is a fantastic deal for resorts that promote for near $1,000 per night time, even when demand is low.

There’s additionally nice worth on the decrease finish of the Hyatt award chart. Class 1 resorts vary from 3,500 to six,500 factors per night time, relying on whether or not you journey on peak, normal or off-peak dates.

Iberia flights to Madrid

Spherical-trip, off-peak flights from New York’s John F. Kennedy Worldwide Airport (JFK), Chicago’s O’Hare Worldwide Airport (ORD) and Boston Logan Worldwide Airport (BOS) to Spain’s capital will solely set you again 34,000 Avios in economic system, 51,000 in premium economic system or 68,000 in enterprise while you switch your Chase factors to Iberia Plus. Contemplating that almost all airways cost not less than 60,000 miles for a one-way business-class award to Europe, you are basically getting a 50% low cost.

Associated: 7 of one of the best airline award chart candy spots

Flights to Hawaii with Alaska and American

By transferring your Final Rewards to British Airways, you may e book awards with Oneworld companions American Airways and Alaska Airways. So long as your nonstop flight distance is underneath 3,000 miles every manner (and saver-level award area is out there), you may leverage British Airways’ distance-based award chart to fly from any West Coast gateway to Hawaii for 40,000 Avios round-trip — after a December 2023 and July 2024 devaluation that noticed costs enhance.

ANA flights booked by way of Virgin Atlantic

For simply 145,000 Flying Membership factors, you may fly round-trip in All Nippon Airways first-class between the West Coast and Tokyo. Flights from different U.S. gateways solely value an additional 25,000 factors (170,000 factors round-trip). Enterprise-class redemptions are an excellent higher deal, costing simply 105,000 to 120,000 factors round-trip, relying in your U.S. departure airport. If potential, you may need to route by way of New York-JFK and fly ANA’s industry-leading “The Room” enterprise class, which is barely accessible on choose routes.

Nonetheless, availability could be tough to return by.

Quick-haul flights to Canada

Aeroplan caught to an award chart for accomplice redemptions however added dynamic pricing for Air Canada flights. In consequence, you may usually discover super-cheap short-haul tickets from the U.S. to Canada. For instance, New York to Toronto Pearson Airport (YYZ) could be booked for underneath 6,000 miles one-way on many dates.

Nonetheless, you may as well discover very cheap award charges on Star Alliance companions by way of Aeroplan — together with Lufthansa, Swiss and EVA Airways.

Associated: Your full information to Star Alliance advantages

What are Chase Final Rewards factors price?

TPG values Final Rewards factors at 2.05 cents apiece, per our October 2024 valuations, and we consider you’ll obtain one of the best worth by transferring factors to airline and lodge companions.

Nonetheless, you may get various values for Chase factors in the event you pursue different redemption alternatives. For instance, Final Rewards factors are price 1.5 cents apiece by way of the Chase Journey℠ portal for Sapphire Reserve cardholders or 1.25 cents for these with the Sapphire Most well-liked or Ink Enterprise Most well-liked card. You will even have entry to Chase Pay Your self Again as a cardholder of any of the above playing cards, and there are often presents to use Chase factors for Apple merchandise or present playing cards at an enhanced worth.

Lastly, Chase factors are price 1 cent apiece if used for easy money again.

How do I earn Chase Final Rewards factors?

There are a lot of methods to earn Chase factors at 1-10 factors per greenback spent, relying on the particular Chase bank card you carry.

The primary three playing cards under earn totally transferable Final Rewards factors by themselves, whereas the remaining 4 are technically billed as cash-back bank cards.

Nonetheless, when you have an Final Rewards-earning card, you may successfully convert your cash-back rewards into Final Rewards factors. For that reason, having a couple of Chase card could make sense to maximise your incomes and redeeming potential.

Listed below are the playing cards that can help you earn Chase Final Rewards factors.

Chase Sapphire Most well-liked Card

Welcome bonus: Earn 60,000 Final Rewards factors after you spend $4,000 on purchases within the first three months of account opening, plus a $300 assertion credit score on Chase Journey℠ purchases inside the first yr.

Why you need it: This can be a incredible all-around journey bank card. It earns factors on the following charges:

- 5 factors per greenback on Lyft (by way of March 2025)

- 5 factors per greenback on all journey bought by way of Chase Journey

- 3 factors per greenback on eating, together with eligible supply companies, takeout and eating out

- 3 factors per greenback on choose streaming companies

- 3 factors per greenback on on-line grocery purchases (excluding Goal, Walmart and wholesale golf equipment)

- 2 factors per greenback on all different journey

- 1 level per greenback on all different purchases

The Sapphire Most well-liked has no international transaction charges and has many journey perks, together with delayed baggage insurance coverage, journey interruption/cancellation insurance coverage and main automobile rental insurance coverage.

Annual payment: $95

Software hyperlink: Chase Sapphire Most well-liked® Card

Chase Sapphire Reserve

Welcome bonus: 60,000 factors after you spend $4,000 on purchases within the first three months from account opening.

Why you need it: The Sapphire Reserve presents incomes energy paired with journey perks that may simply cowl the annual payment. It earns factors on the following charges:

- 10 factors per greenback on Lyft (by way of March 2025)

- 10 factors per greenback on Chase Eating booked by way of Final Rewards

- 10 factors per greenback on lodge and automobile rental purchases by way of the Chase Journey

- 5 factors per greenback on airline journey booked by way of Chase Journey

- 3 factors per greenback on journey not booked by way of Chase

- 3 factors per greenback on different eating purchases

- 1 level per greenback on all different eligible purchases

Different perks embrace an easy-to-use $300 annual journey credit score, a payment credit score for International Entry or TSA PreCheck (as much as $120 as soon as each 4 years) and Precedence Cross Choose lounge entry in addition to the rising checklist of recent Sapphire lounges. Cardholders additionally get main automobile rental protection, journey interruption/cancellation insurance coverage and different protections.

Annual payment: $550

Software hyperlink: Chase Sapphire Reserve®

Ink Enterprise Most well-liked Credit score Card

Welcome bonus: 90,000 factors after spending $8,000 on purchases within the first three months from account opening

Why you need it: This is among the greatest bank cards for small-business homeowners, incomes 3 factors per greenback on the primary $150,000 spent in mixed purchases on journey, transport purchases, web, cable and telephone companies, promoting made with social media websites and search engines like google every account anniversary yr. You earn 1 level per greenback on all different purchases, and factors do not expire so long as your account is open.

Annual payment: $95

Software hyperlink: Ink Enterprise Most well-liked® Credit score Card

Money-back Chase bank cards

4 Chase bank cards are technically billed as cash-back merchandise. Nonetheless, suppose you’ve got one of many three playing cards famous above. In that case, you may mix your factors in a single account, changing these cash-back rewards into totally transferable Final Rewards factors.

Even higher? None of those playing cards cost an annual payment.

Listed below are the 4 playing cards that provide this performance:

- Chase Freedom Flex®: Earn $200 after you spend $500 within the first three months of account opening. Earn 5% again on choose bonus classes, which rotate each quarter and apply on as much as $1,500 in mixed spending (activation required). Plus, earn 5% on journey bought by way of Chase Journey, 3% on eating at eating places (together with takeout and eligible supply companies) and three% on drugstore purchases.

- Chase Freedom Limitless®: Earn a further 1.5% money again on every little thing you purchase (on as much as $20,000 spent within the first yr), price as much as $300 money again. Plus, earn 5% on journey bought by way of Chase Journey, 3% on eating at eating places (together with takeout and eligible supply companies) and three% on drugstore purchases. Earn 1.5% on all different purchases.

- Ink Enterprise Money® Credit score Card: Earn as much as $750: $350 bonus money again after you spend $3,000 on purchases within the first three months, and a further $400 while you spend $6,000 on purchases within the first six months from account opening. Earn 5% money again on the primary $25,000 in mixed purchases at workplace provide shops and on web, cable and telephone companies every account anniversary yr (then 1%). Earn 2% money again on the primary $25,000 spent in mixed purchases at gasoline stations and eating places every account anniversary yr (then 1%).

- Ink Enterprise Limitless® Credit score Card: Earn $900 money again after spending $6,000 on purchases within the first three months from account opening. Earn limitless 1.5% cash-back rewards on each buy.

Notice that Chase additionally points the Ink Enterprise Premier® Credit score Card. Nonetheless, the earnings on this card cannot be mixed with others within the Final Rewards ecosystem.

Learn extra: Your information to the Chase Ink Enterprise bank cards

Backside line

When you worth the pliability of selecting from 11 airline companions and three lodge companions, Chase Final Rewards is one in every of our favourite bank card applications at TPG.

Within the age of no-notice devaluations by some loyalty applications, it’s good to earn Final Rewards by way of the vary of bank card welcome presents, class bonuses and on a regular basis spending, after which preserve your Final Rewards factors till you’re able to switch and e book with an airline or lodge accomplice.